- Finance

Destroying Value and the Misuse of Indicators

‘Great swathes of wealth have been destroyed because of a common tendency among business executives to confuse value and share price, and to believe that achieving KPI targets is tantamount to value creation.’ Prof. Kevin Kaiser, INSEAD

The journey to the grassy, sunlit uplands where businesses are rich in created value does not follow an easy or obvious path; and in recent decades swathes of executives and consultants have devoted much time and developed processes that create short-term share price rises in response to the demands of financial analysts who need specific numbers to fit their performance criteria that have in many cases diverted managers from creating real long-term value for short-term share price spikes.

Kevin Kaiser, Professor of Management Practice and Director of the Transition to General Management Programme at INSEAD, has been differentiating between real long-term value creation and what managers often do instead which is chase pre-defined indicators and so ultimately destroying value.

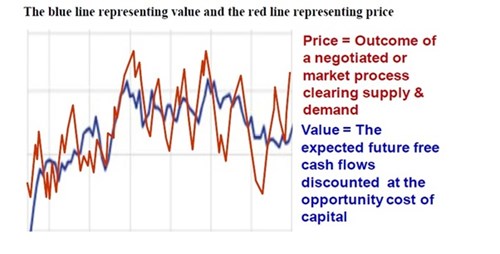

Kaiser describes the real value of a business, as being ‘the future free cashflows of the business discounted at the opportunity cost of capital’, which is finance professor speak for the money out of a project must be greater than the money invested, taking into consideration what other uses you could have made of that invested money. These he sets against the market value of a business as described by its share-price, which of course is also affected by external events as well as internal ones.

In a paper on this topic ‘The Perils of Indicator-Driven Management’ Kaiser describes this process…

… we introduce a concept called “blue-line management,” an approach in which all decisions of consequence are made with one aim: to create value. This approach stands in stark contrast to the more common practice of “red-line management” in which value creation may be the stated goal, but the business is managed to deliver on specific indicator targets, independent of whether these efforts are value creating or value destroying.

The red- and blue-lines are those that depict share price value and NPV value as in the figure below:

Kaiser is not anti-indicator though, he accepts that organisations require Known Performance Indicators (KPIs) to enable them to assess how the business is progressing but also is adamant that

… the primary function of KPIs is to promote organizational learning, a mission that will certainly be undermined when indicators are used for incentives… To punish managers for failing to deliver on KPI targets is similar to punishing a scientist who fails to reject a null hypothesis when performing a laboratory experiment. ..Indeed, much of the most useful organizational learning occurs through failure. When companies are managed on the red line, extraordinary amounts of time and energy are devoted to hiding failure, enabling managers to avoid the punishment that comes from not meeting KPI targets.

As such Kaiser when engaging with executives takes not so much the typical finance professor’s approach of focusing on the arithmetic intricacies of net present value and other finance concepts, but rather changing attitudes and so behaviours in executives and managers so that they can appreciate the larger, integrated whole of the business system rather than focusing on narrow indicators that, in themselves, do nothing to create value and frequently destroy it.

His idea of using KPIs to create learning organisations is very much at the cutting-edge of new organisational thinking – and his use of ‘hard issue’ finance to progress that is welcome and refreshing.

As one of the world’s leading and largest graduate business schools, INSEAD brings together people, cultures and ideas from around the world to change lives and to transform organisations.

ARTICLES YOU MIGHT LIKE

VIEWPOINT

Rotman School of Management’s David Goldreich discusses business finance, valuation, and planning for a post-pandemic recovery

DEVELOPING LEADERS QUARTERLY MAGAZINE AND WEEKLY BRIEFING EMAILS